Get the free fillable hud1a

Show details

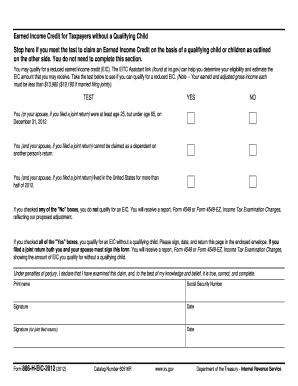

1005. Annual Statement Settlementassessments HUD-1A OMB Approval No. 2502-0265 WinClose www. FeeSimple.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hud1a fillable form

Edit your prntable hud1a with sellers form online

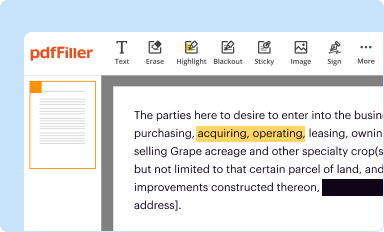

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

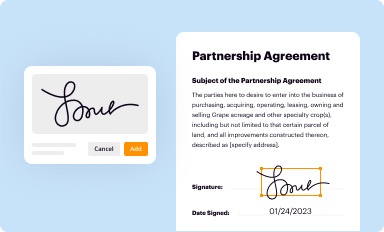

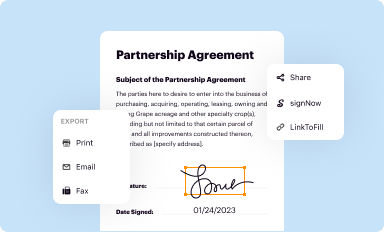

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hud1a form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

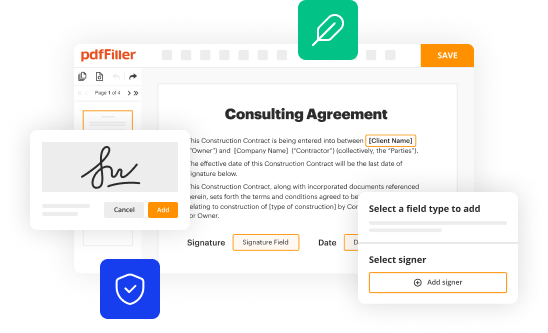

Editing hud1a form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hud1a form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hud1a form

How to fill out HUD1a:

01

Start by gathering all necessary information and documents related to the transaction, such as the sales contract, loan information, and any other relevant paperwork.

02

Begin filling out the top section of the HUD1a form, which includes the name of the borrower, lender, settlement agent, and other key details. Ensure accuracy and double-check all the information before moving on to the next section.

03

Proceed to Section J, where you will provide information about the borrower and seller, including their names, addresses, and contact details. Fill in any additional information required, such as the borrower's tax identification number.

04

In Section L, input the details of the loan and purchase terms. Include the loan amount, interest rate, loan term, and any other relevant financial information.

05

In Section M, record the necessary calculations related to the loan, including the total settlement charges, cash from the borrower, and cash to the seller. Double-check all calculations to ensure accuracy.

06

Section N requires the completion of the disbursement information. This section outlines all the fees and charges associated with the transaction, such as loan origination fees, prepaid interest, and mortgage insurance premiums.

07

Continue with Section O, which details the amounts received by the borrower and the seller. Record all the funds associated with the transaction, including the down payment, seller credits, and any other financial contributions.

08

In Section P, list any required reserves and/or adjustments. This section often includes items like property taxes, homeowner's insurance premiums, and prepaid items not yet disbursed.

09

Progress to Section S, where you will disclose the settlement charges and the borrower's and seller's respective charges. This section provides a summary of fees paid by each party and should be carefully reviewed for accuracy.

10

Finally, review the completed HUD1a form thoroughly, ensuring all information is accurate, calculations are correct, and all necessary signatures and dates are included. Make any required adjustments, print copies for all parties involved, and keep a copy for your records.

Who needs HUD1a:

01

Homebuyers: HUD1a is a required document for homebuyers who are obtaining a mortgage loan. It provides a detailed breakdown of all the financial aspects of the transaction, allowing them to understand the costs and charges associated with the purchase.

02

Sellers: Sellers involved in the real estate transaction will also need a HUD1a form. It allows them to review the financial implications of the sale, including any credits or charges they may be responsible for.

03

Lenders and Settlement Agents: Mortgage lenders and settlement agents use the HUD1a form to prepare and document the financial aspects of the transaction. It ensures transparency and compliance with the Real Estate Settlement Procedures Act (RESPA) requirements.

04

Real Estate Professionals: Real estate agents and brokers involved in the transaction may need the HUD1a form to assist their clients in understanding the financial breakdown of the sale. It helps agents provide accurate information and address any questions or concerns their clients may have.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between HUD-1 and hud1a?

Both the HUD-1 and HUD-1A were used in almost all real estate transactions prior to Oct. 3, 2015. The HUD-1 is a longer form used in transactions involving a seller. The HUD-1A is a shortened form used optionally for transactions without a seller, such as a mortgage refinance or subordinate lien loans.

Are HUD-1 forms still used?

The HUD-1 form, listing all closing costs, is given to all parties involved in reverse mortgage and mortgage refinance transactions. Since late 2015, a different form, the Closing Disclosure, is prepared for the parties involved in all other real estate transactions.

Who prepares the HUD-1 settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan.

What replaced the HUD-1 form?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Is a HUD-1 required for a cash sale?

The HUD-1 must be used in any transaction where a federally regulated mortgage (deed of trust) is involved. In your case, because you are selling for cash, you don't need to use that form. However, it's a good form, and can be of assistance to you and your buyer when you both are preparing your income tax returns.

Are HUD 1s still used?

HUD-1s are still in use, but in specific situations only. HUD-1s are used in conjunction with reverse mortgages, line of credit loans, residential properties being purchased with commercial loans, and by lenders who do a certain number of loans a year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my hud1a form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your hud1a form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the hud1a form electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your hud1a form in minutes.

How do I fill out the hud1a form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign hud1a form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is hud1a?

Hud1a is a form used in real estate transactions to itemize all charges and fees that a borrower and seller must pay during the settlement process.

Who is required to file hud1a?

The settlement agent or closing agent is typically responsible for preparing and filing the HUD-1 form.

How to fill out hud1a?

The HUD-1 form should be filled out by the settlement agent based on the information provided by the buyer, seller, and lender involved in the transaction.

What is the purpose of hud1a?

The purpose of the HUD-1 form is to provide a detailed breakdown of all the charges and fees associated with a real estate transaction, ensuring transparency for all parties involved.

What information must be reported on hud1a?

The HUD-1 form typically includes information such as the purchase price, loan amount, closing costs, prepaid expenses, and any credits or adjustments due to the buyer or seller.

Fill out your hud1a form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

hud1a Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.